10/27/2016

1

North Carolina Department of State Treasurer

Staff of State and Local Government Finance Division

October 27, 2016

Becky Dzingeleski, Senior Accounting &

Financial Management Advisor

Cash and Investments –

Current Issues In North Carolina

10/27/2016

2

Agenda

• Banking – Collateralization

• Pooling Bank Memo & list (handout #1)

• Custody & Safekeeping

• Current Cash & Investment Issues

• Local Government Reporting Requirements

– DST Website

– LGC 203 – sample reports

• LGC203 EZ (handout #2)

• Standard LGC 203 (handout #3)

– COLL 91- Annual Notification of Accounts by

Public Depositor

(handout #4)

• Comparative portfolios, statistics

Banking & Collateralization in NC

• NC Banking

– Banking Commission

– State Treasurer – Banking Operations

• Collateralization – required by law

– Dedicated method – finance officer monitors

collateral

• FDIC coverage is per Bank

• Recognizes one Official custodian

– Pooling method – State Treasurer monitors

collateral

10/27/2016

3

Banking & Collateralization

– Know your bank and their history

– Watch the Pooling Bank List – DST website

– Dedicated banks – make sure your

agreements are in order & that you monitor

your collateral

• COLL-94A – Security agreement; COLL-94B

Escrow agreement

• “Collateral & Public Deposits in NC”

These documents located at www.nctreasurer.com

Variation: FDIC pass-through protection

[G.S. 159-30(b1) for CDARs & ICS – G.S. 159-31(a) for Finistar]

• CDARs, Insured Cash Sweep, Finistar

Banking & Collateralization

Issue - As of LGC-203 report date there is insufficient

collateralization (Market Value) or no collateralization for

deposit accounts in NON-pooling Banks that are required

to collateralize the Units public funds by use of the

dedicated method.

o“Appropriate forms that were needed for the Bank to

collateralize the deposits had not been filed”

10/27/2016

4

Banking – Official Depository

• G.S. 159-31(a)

– The governing board of each local government

and public authority shall designate as its

official depositories one or more banks, savings

and loan associations, or trust companies in

this State…”

• An acceptable “official depository” must:

– have a presence in the state,

– be open for business to the general public,

– agree to meet NC collateral requirements.

Use of Credit Union’s as a NC Local Government or Public

Authority Depository is not specified in the NC Statutes

Custody and Safekeeping

G.S. 159-30 (d) “…. Securities and deposit certificates

shall be in the custody of the finance officer who shall

be responsible for their safekeeping and for keeping

accurate investment accounts and records.”

• Custody has to do with the physical safety of the

securities. In the “book-entry” system there are no

physical documents so investment securities must be

held by custodians in Third Party safekeeping or trust

accounts in the name of the Unit of Government.

Best Practice: Signed Third Party safekeeping contract

directly between the Unit and the custodian.

10/27/2016

5

Custody and Safekeeping

§ AG Advisory Memo #2013-03

§ Investments can be held in “safekeeping” accounts or trust

accounts in the following

§ Commercial banks in North Carolina

§ Trust accounts in banks authorized to do trust work in North

Carolina

§ Commercial Bank or Trust Department’s Safekeeping

responsibilities

§ Separation and identification are federal banking regulatory

requirements

§ Hold assets separate and apart from bank assets

§ Readily identifiable and account for as local government assets

§ Securities in the name of unit is the best practice

§ Unit should maintain documentation of activity

Bank’s investment or operating arm cannot provide custody

What services does your custodian provide?

• If custodian is buying / selling securities for you

they become the “counterparty” under the

definitions of GASB Statements 3 and 40

– If they both provide and safe keep the security

investment you have a Category C investment – least

favorable

– “Third party” custodial agreements are the strongest and

most secure custody arrangements: the broker and the

custodian are separate – most favorable

• GFOA best practice and a Category A

investment under GASB

Role of Custodian & Custodial risk

10/27/2016

6

Use of outside investment managers requires

special legislation

– State Treasurer has authority in G.S. 147-69.3

– Comparable language does not exist in G.S.159

– Those with authority to use outside managers

have gone to the general assembly for special

legislation

– Therefore, outside managers are not allowed

under G.S. 159 and their use requires special

action by the legislature

Investment Managers – NC SLGFD Position

10/27/2016

7

Certificates of Deposit – CD’s

GS 159-30(b) Moneys may be deposited at interest

in any bank, savings and loan association, or trust

company in this State in the form of certificates of

deposit or such other forms of time deposit as the

Commission may approve…….

vThe only CDs that are allowed under the law are those

where the Unit of Government deposits the funds in a

bank “in this State” subject to collateral

vBrokers sometimes offer an investment product called

“brokered CDs” typically from out of state banks

Brokered CD investments are not authorized

under G.S. 159-30

Money market accounts

• Money Market Deposit Account

versus Money Market Mutual Fund

• “Money market” has different meanings

and you must determine how it is used

• NC statutes allow MMDAs

(Money Market Deposit Accounts)

• Verify with bank that account is FDIC

insured and collateralized

10/27/2016

8

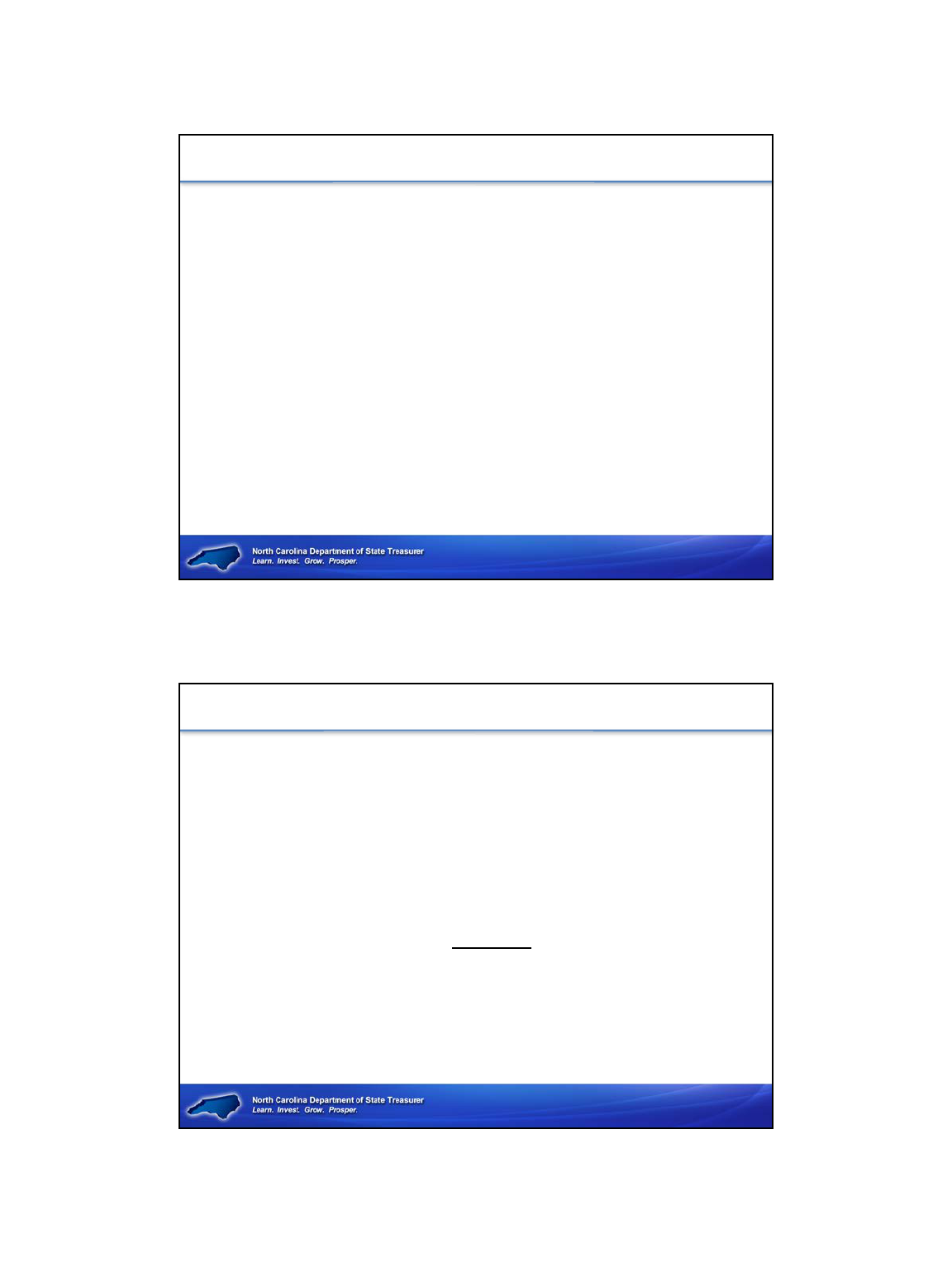

Money Market Demand Account

versus

Money Market Mutual Fund

Money Market Deposit

Account

Money Market Mutual

Fund

Liquid

Yes Yes

Competitive Interest

Rate

Yes Yes

Limited Withdrawals

Yes No

Annual Fee

No Yes

FDIC Insured

Yes No

Statutorily Allowable

Yes No – except for NCCMT

Commingled Investment Pools

159-30(c)(9) & (10)

•

Commingled investment pool established and administered by

the State Treasurer

§ Short Term Investment Fund (STIF) G.S. 147-69.

§ Boards of Education & select local government units

§ OPEB Trust Funds – State Treasurer

§ 17 participants as of 7.30.2016

Interested Units can contact NPPI@nctreasurer.com. Someone

will get back to you. There is a minimum investment amount.

§ Hospital Investment Fund – State Treasurer

Commingled investment pools established by interlocal

agreement are no longer used since establishment of

NCCMT

10/27/2016

9

Endowments

NC Local Governments & Public Authorities are

legally bound by §159-30 regarding authority to

invest

• Carefully read & understand the endowment documents

o Unit has complete discretion to invest?

o If Unit changes investment type will they lose

endowment?

o Consult Units attorney

Exception – Public Schools

Public Schools - Endowment funds

Unique Investment authority: Session Law 2011-284

•

Section 77 re-writes §115C-490

Creation of endowment funds; administration

o Any local board of education is hereby authorized and empowered

upon the passage of a resolution to create and establish a permanent

endowment fund which shall be financed by gifts, donations, devises,

or other forms of voluntary contributions.

o Any endowment fund established under the provisions of this Article

shall be administered by the members of such board of education

…known as "The Board of Trustees of the Endowment Fund…. The

board of trustees so established shall determine its own organization

and methods of procedure."

10/27/2016

10

Public Schools - Endowment funds

• Section 78 re-writes §115C-491

Board of Trustees public corporations; powers & authority

generally; investments

...Board of trustees created and organized under this Article shall be a body

politic, public corporation and instrumentality of government and as such may

sue and be sued in matters relating to the endowment fund and shall have the

power and authority to acquire, hold, purchase and invest in

o all forms of property, both real and personal, including, but not by way of

limitation, all types of stocks, bonds, securities, mortgages and all

types, kinds and subjects of investments of any nature and

description.

o may receive pledges, gifts, donations, devises and bequests, devises, and

may in its discretion retain such in the form in which they are made, and

may use the same as a permanent endowment fund.

o The board of trustees shall be responsible for the prudent investment of

any funds or moneys monies belonging to the endowment fund in the

exercise of all forms of property, both real and personal

Investing Bond Proceeds

• Must follow G.S. 159-30 – no exceptions

– Even units with expanded investment

authority from special legislation must use

G.S.159-30 for bond proceeds

– Be wary of financial advisors or banks with

creative proposals – call us if something

needs clarification or investigation

10/27/2016

11

Investing Bond Proceeds

• Use of Mutual Funds for Bond proceeds

– NCCMT clearly permitted by Statute,

recertified in 2016

– Other mutual fund investments would require

bond counsel’s approval with the proper

criteria -

G.S. 159-30(c)(13)

• Proceeds must be for projects subject to arbitrage

– vendor must provide arbitrage tracking

• Investments in the fund must have highest ratings

• Mixed legal opinions on the use of mutual funds

other than NCCMT – consult legal counsel

INVESTMENT ISSUES -

NC ST HSG FIN AGY HOMEOWNERSHIP – not a municipal

corporation, local government agency, or an obligations of the

State of NC - G.S.159-30(c)(3)

NORTH CAROLINA CAPITAL FACILITIES FINANCE AGENCY -

Educational Facilities Revenue and Revenue Refunding

Bonds –NCCFFA is conduit issuer that permits an entity

(University) to borrow on a tax-exempt basis. Bonds are not an

obligation of the State of NC but are an obligation of the University.

UNIVERSITY REVENUE BONDS must be evaluated on a case by

case basis. Revenue Bonds are most often backed by Dorm fee

revenue & normally are not obligations of the State of NC -

G.S.159-30(c)(3)

10/27/2016

12

INVESTMENT ISSUES -

NC MED CARE COMMISSION BONDS

MCC Is an agency of the State of NC, their

bonds are not obligations of the State of NC as

required under §159-30 (c)(3).

CERTIFICATES OF PARTICIPATION (COPs)

of NC local governments are not “bonds and

notes” as required by the statutes. Not issued

by the local government or public authority but

by a nonprofit corporation.

Summary

§ Status of collateral method chosen by banks can

change due to mergers

vPooling Method vs. Dedicated Method

§ Collateralization - “Dedicated Method” can be

complicated. Refer to Collateralization Of Public

Deposits In North Carolina – examine agreements

with Dedicated method Depositories

§ Official Custodian – examine custodial agreements

vSigners on an account does not automatically

make them official custodians to the FDIC

10/27/2016

13

• “Brokered CD’s” are generally not allowable for most NC

Local Government Investments

• “Money market” deposit accounts are allowed -

investments in mutual funds are limited by law. Ask for

more details on the “Money market” account being

offered – deposit or investment?

• Public Schools have special authority to invest

endowments, all other Local Governments do not have

this same authority

• Not all Bond investments are allowable, read the offering

documents

Summary

Deposit and Investment Local

Government Reporting Requirements

10/27/2016

14

“LGC-203 report forms are now available”

How does the LGC make announcements or

send reminders?

LGC_News listserve

Best way to stay informed is through LGC_News

listserv. Register multiple people on your staff in case

you are out of the office.

Provide a business card or send an email request,

to get registered.

ANNOUNCEMENTS / REMINDERS

LGC-203

Report of Deposits and Investments

o Required by G.S. 159-33 Local

Governments / Public Authorities

o Required by G.S. 115C-446 for Public

Schools

**Not required for Charter Schools

NC General Statutes are available without

charge at the web site of the North Carolina

General Assembly at www.ncga.state.nc.us.

10/27/2016

15

ABC Board’s

Required by § 18B-702 (t) for ABC Boards –

ABC Board 203 report forms are reviewed by

and accessed at the NC ABC Commission

Website.

LGC-203 – Report of Deposits and Investments

LGC 203 Reports

G.S. § 159-33. Semiannual reports on status of

deposits and investments.

• Each officer having custody of any funds of any local

government or public authority shall report to the

secretary of the Local Government Commission on

January 1 and July 1 of each year (or such other dates

as he may prescribe) the amounts of funds then in his

custody, the amounts of deposits of such funds in

depositories, and a list of all investment securities and

time deposits held by the local government or public

authority………

10/27/2016

16

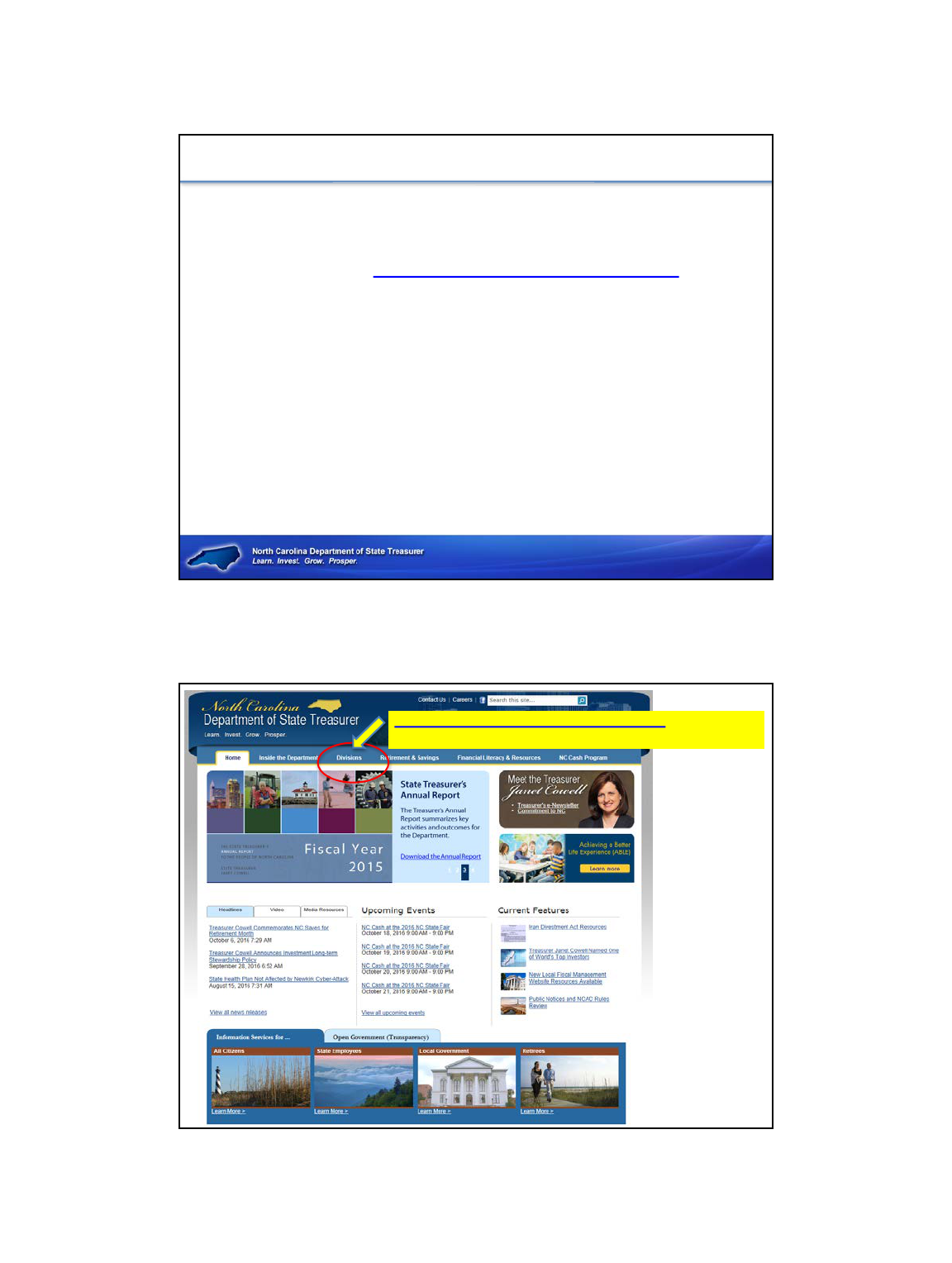

LGC 203 Reports

(Semi-annual Report on Deposits & Investments)

LGC-203 Report forms, instructions & Memos will

be found on the NC State Treasurer's Website

Please use most current updated report form

every reporting cycle

**

Forms must be saved to your own system first, opened from

your own system then completed. Cannot prepare them from the

DST website – Yet.

June 30

th

- report due by July 25

th

Dec 31

st -

report due by January 25

th

https://www.nctreasurer.com/Pages/default.aspx# .Hoverover

divisionsthenclickonState&LocalGovernment

10/27/2016

17

ClickonLocalFiscalManagement

10/27/2016

18

Position

pointerover

filename.

Rightclick

thenSave

thereport

formto

yourown

System…

INV91isnowCOLL-91

https://www.nctreasurer.com/slg/lfm/forms-

instructions/Pages/Cash-and-Investments.aspx

https://www.nctreasurer.com/slg/lfm/forms-

instructions/Pages/Cash-and-Investments.aspx

Handout#1

10/27/2016

19

As of the report date: June 30 or December 31

– Ending statement balances in total from

each depository

• Finistar – enter both dedicated amounts and

pooling amounts separately on the report

• CDARs

• Insured Cash Sweeps (ICS)

– Investments Market Value

If the funds are in the name / tax ID of the Local

Government they should be on the LGC-203

LGC-203 reports - What goes on the form?

ØCompleted Excel workbook report form is

preferred or a signed scanned PDF copy

of the report form

ØSupplemental schedules (Investments)

ØCollateral statements (Dedicated method of

collateralization)

ØFinistar, CDARs, ICS statements as of the

LGC-203 report date

(June 30 or December 31)

LGC-203 reports – Emailing the report

10/27/2016

20

LGC-203 Reports

Why is it required ?

G.S. 159-33

§ Two times a year LGC staff reviews LGC-203

report & counsels unit for:

§ Cash balances & adequate collateral

§ Allowable investments and maturities

§ Cross reference of statute violations to note

disclosures in the Financial Statements

§ Communication if Statutory Violation –

§ Phone Call with email to Unit’s finance officer

§ Letters written if appropriate

§ Letters copied to Auditor

LGC 203 - Basics

Both the EZ & Standard Report form’s and related macros for

automated processing are updated every reporting cycle with

• Dates, New Units, Pooling Banks, Instructions

Updated LGC-203 report forms, Memos & instructions posted to

NC DST Website then announced through

LGC_News listserve

June 30 report is due July 25

December 31 report is due January 25

Not sending LGC 203 / COLL 91 is a

Statutory Violation

Sending LGC-203 / COLL 91 Report late – Not a Statutory Violation

10/27/2016

21

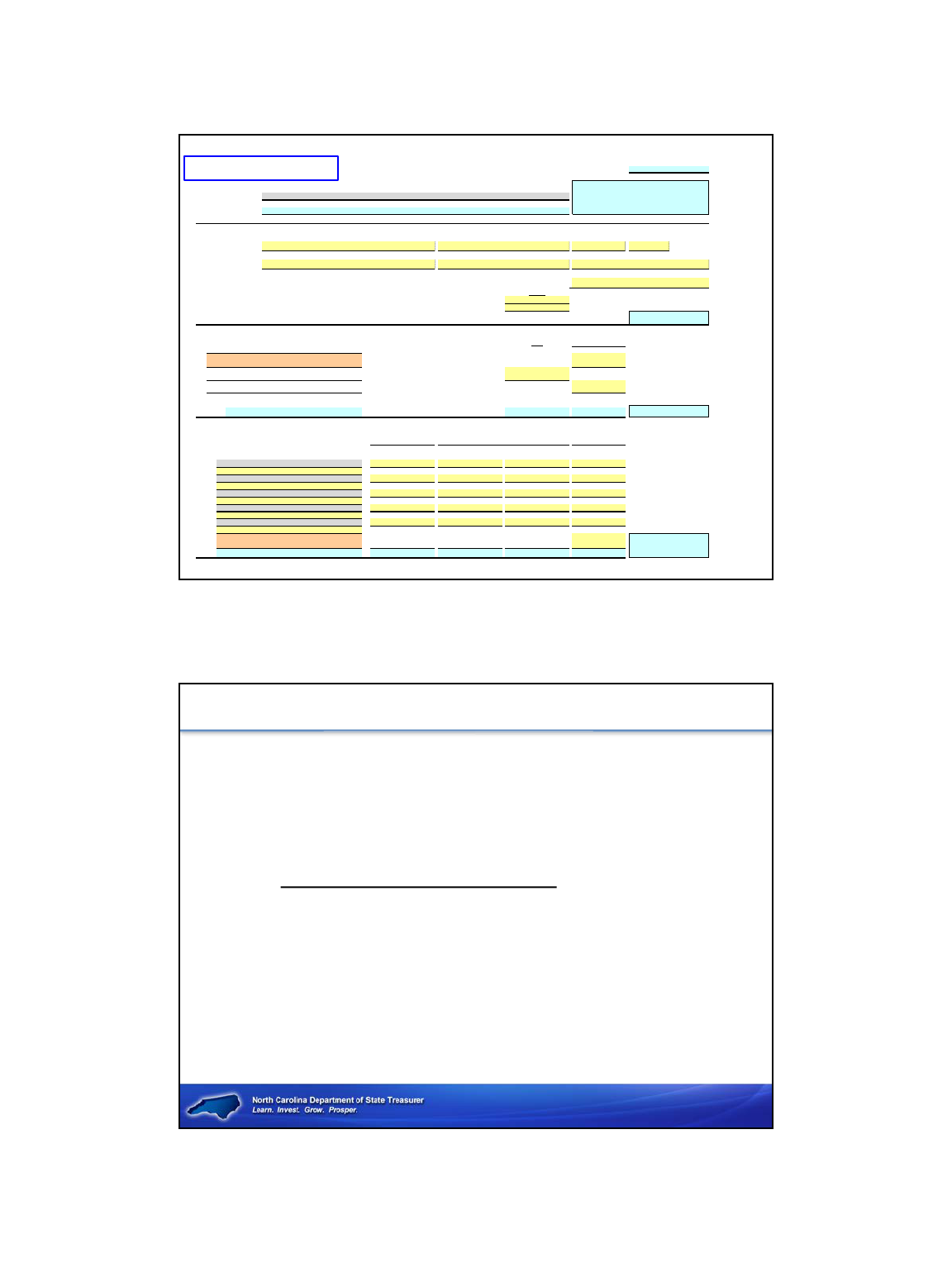

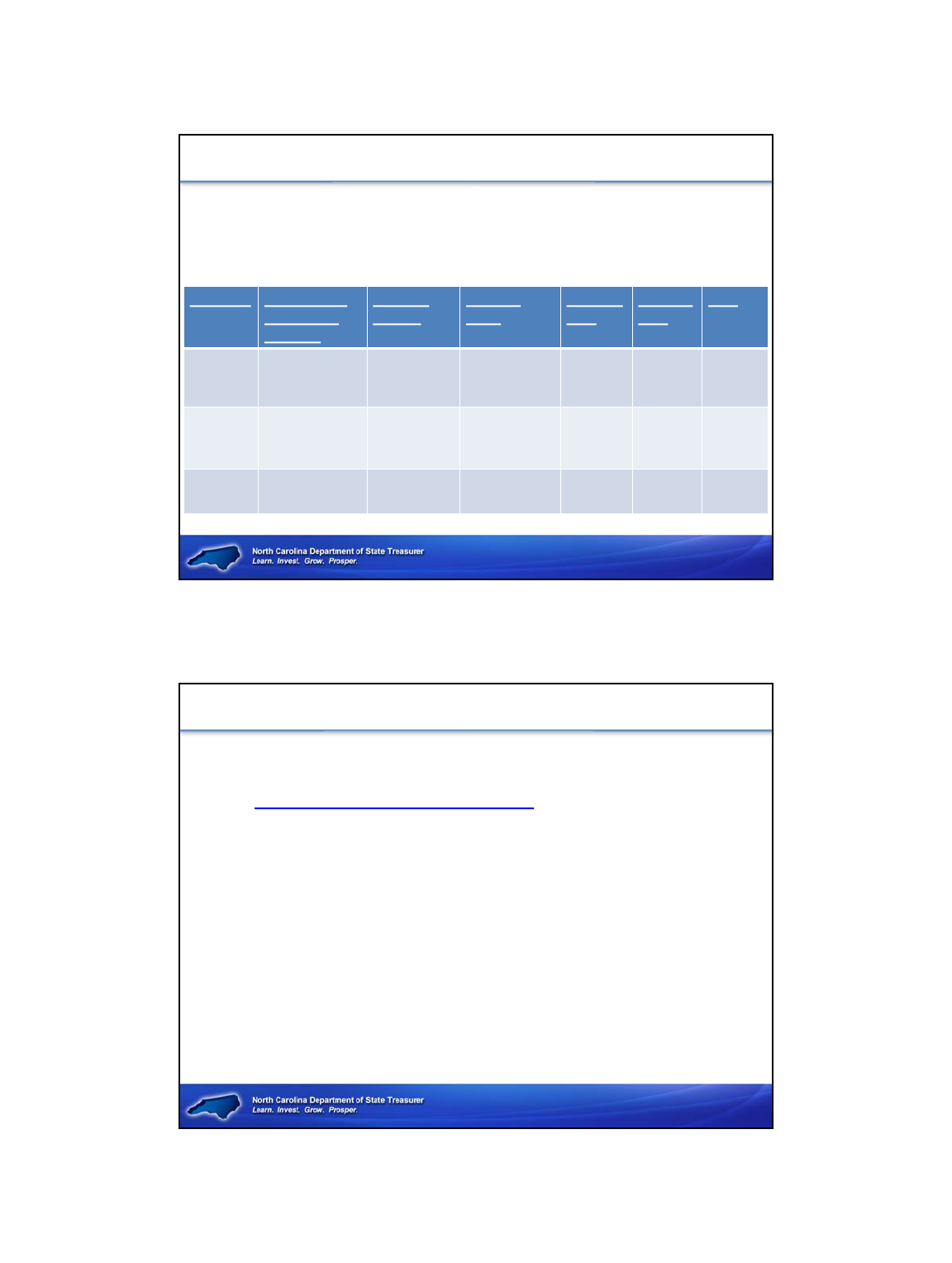

LGC203 EZ (Rev. 6-2016) IMPORTANT-Please read the FORM REMINDERS tab

AS OF

As of : June 30 2016

Name of Unit **

Unit Code Unit Type

Rec'd Date

** Note - Discretely Presented Component Units must submit separate LGC-203 reports

Legal Name of Unit:

CERTIFICATION

Telephone Number, includi ng area code

This is to certify that the

Name of Official (Type or print your name) Unit Mai li ng Address - Street Number Extension

data contained in this

report is accurate to the

Title (i.e. Finance Officer, Treasurer, etc) Unit - City, State & Zip Code

best of my knowledge

and belief.

Signature of Official (only if mailing or faxing)

I.

Cash on hand

Amount

Petty cash funds and change funds

……………………………………………

Undeposited receipts

……………………………………………

Total Cas h on Hand

II.

De dicated Met hod Financial Ins titutions

** If you have addi ti onal depos its in Dedi cated Banks ( non-po ol ing ), you must use the LGC-2 03 St andard Fo rm

Interest Bearing

C.D.s Chec king Acco unts

Finis tar Dedicated Amounts

CDARS - attach statement or leave blank if NA

ICS - attach statement or leave blank if NA

Total Dedicate d Deposits

Totals for Finistar, CDARS and ICS -$ -$

III.

Pooling Me tho d Financial Inst itutions

** LIST ONLY BANKS INCLUDED ON NC POOLING BANK MEMO

Sel ect B ank Name from Dro p Down Menu Demand Interest Bearing

Please do not select the same bank name more than once

Deposits Chec king Acco unts

Enter total amount for each bank Account type going across Regular Savings C.D.s

(1)

(2)

(3)

(4)

(5)

Total Pooling Deposits

Finistar Pooling amounts ------

Totals for All Pooling Banks $ $ $ $

IV.

Investments NCCMT

Amount

CASH DEPOSITS & INVESTMENTS

LOCAL GOVERNMENT COMMISSION

Emai l Addre ss

$

……………………………………………………………………………………………………

3200 Atlantic Avenue, Raleigh, North Carolina 27604

State of North Carolina

(As required by G .S. 159-33)

Deposits

$

Time

……………………………………………………………………………………………………

LGC Use Only

…………………………………………………………………

$

FINISTAR (total dedicated amount from statement)

attach statement or leave blank if NA

REPORT OF DEPOSITS AND INVESTMENTS

FINISTAR (total pooling amount from statement)

attach statement or leave blank if NA

…………………………………………………………………

Handout#2

LGC-203 EZ Form

• One Page Form

• Units that have Deposits in Pooling Method

Banks, Investments in NC Cash Management

Trust Cash or Term Portfolio , Finistar, CDARs

and have No other investments

• Ideal for almost all Local Government’s who only

have deposits accounts and invest in only the

NC Cash Management Trust

• Not for use by Board of Education’s or Public

Housing Authorities

10/27/2016

22

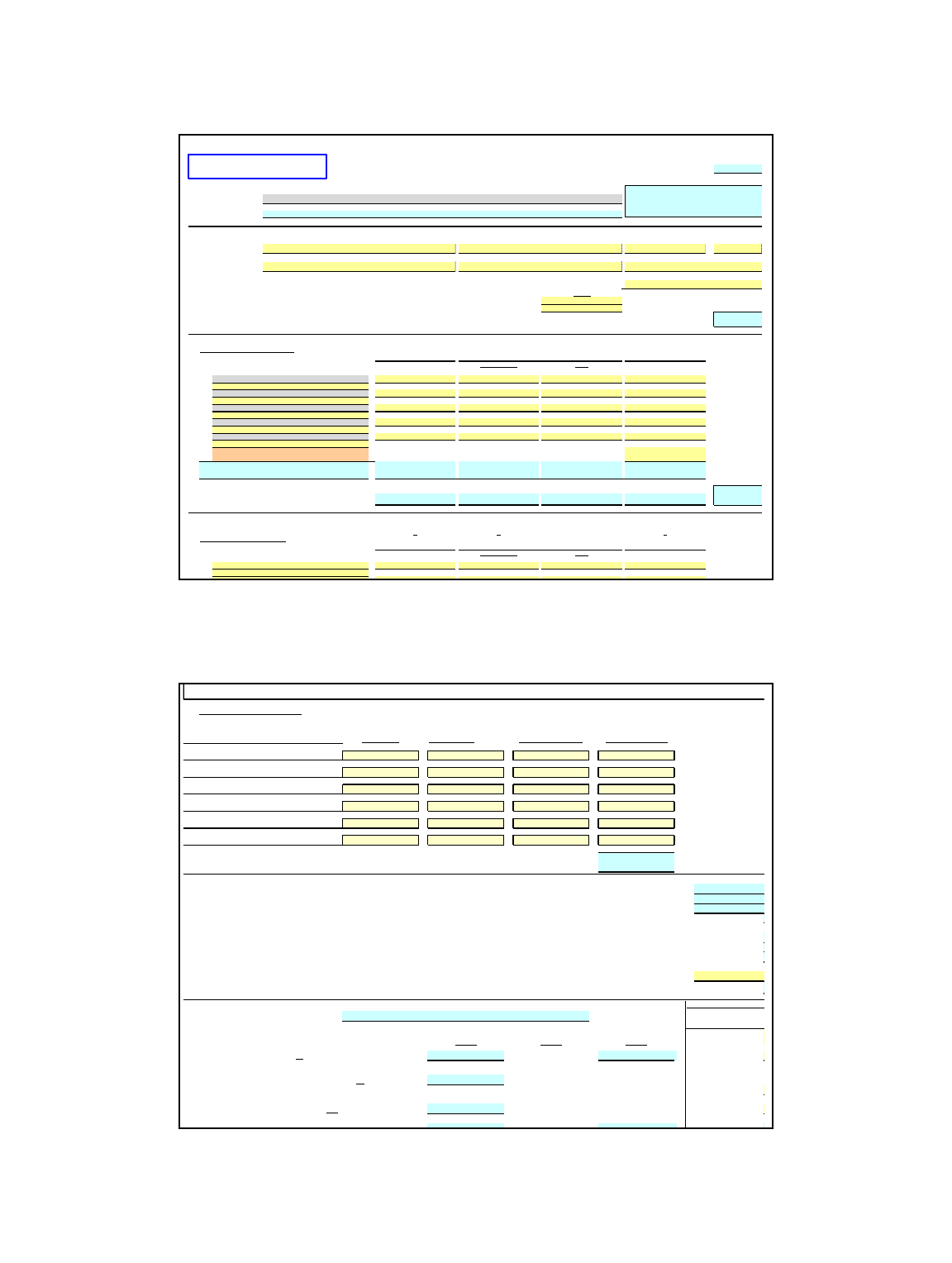

Standard LGC 203 (Rev. 6-16), page 1

IMPORTANT - Please read the form reminders tab and sample 203 for assistance.

AS OF

JUNE 30

LGC Use Only

Name of Unit:

Unit Code Unit Type

Legal Name of Unit:

CERTIFICATION

Telephone Number, includi ng are a code

This is to certify that the Name of Official (Type or print your name) Unit Mai li ng Address - Str eet Number Extension

data contained in this

report is accurate to the

Title (i.e. Finance Officer, Treasurer, etc) Unit Mai li ng Address - Ci ty, State & Zip Code

best of my knowledge

and belief.

Signature of Official (only if mailing or faxing)

I.

Cash on hand

(see Instruction 2).

Amount

Pe tty cash funds and change funds ……………………………………………

Undepo sited receipts ……………………………………………

Total Cas h on Hand

Manual Pre parers: ENTER TOTAL CASH ON PAGE 2 S ECTION VI LIN

II.

Pooling Me thod Financ ial Inst itutions

Manual Preparers: LIST ONLY BANKS INCLUDED ON POOLING BANK MEMO

Select Bank from Drop Down menu Demand Interest Bearing

Do not se le ct the same bank name more tha n one time

Deposits Chec king Acco unts

Enter total amount for each Account type at the bank goi ng across Regular Savings

C.D.s

(1)

(2)

(3)

(4)

(5)

---

Total Pooling Bank

$ $ $ $

Grand Total Pooling D

Grand Totals for All Poo ling Banks $ $ $ $

Manual Pre parers: ENTER GRAND TOTAL ON PAGE 2 SECTION VI L

III.

De dicated Met hod Financial Institution

(see Instruction 3 & 5): Note: All Housi ng Authorities mus t use the De dicated Met hod rules.

Manual Preparers: fill out Section VII on Pg.2 for each Dedicated Bank

A B C

List the Bank Name and location Demand Time Interest Bearing

Do not ent er the same bank name more t han once

Deposits Deposits Chec king Acco unts

Enter total amount for each Account type at the bank going across Regular Savings C.D.s

(1)

(2)

(As required by G.S. 159-33 and G.S. 115C-446)

CASH DEPOSITS &

State of North Carolina

LOCAL GOVERNMENT COMMISSION

3200 Atlantic Avenue, Raleigh, North Carolina 27604

REPORT OF DEPOSITS AND INVESTMENTS

Deposits

$

Emai l Addre ss

$

FINISTAR (total pooling amount from statement) attach

statement or leave blank if NA

Supplemental Pages - TOTALS (Pooling Method)

Time

Handout#3

Standard LGC 203 (Rev. 6-16), Page 2

V. Investments (see Instruction 7): Se nd your own suppleme ntal re port that includes details and market value totals for each type belo w.*(se nd wit h LGC-203 )

INVESTMENT TOTALS Name of Custodian

or Safekeeper

Type of Security Purchase Amount Total * Market Value Total

Government Securities

$

Government Agencies

$

Commercial Paper

$

Bankers' Acceptance

$

Other Investments

$

Repurchase Agreements (see Instruction 8):

$

Grand Total of Sect. V Investments (See Instruction 9)

VI.

Summary

(s ee Ins truction 1 1)

:

Please recheck totals.

(1) Cash on hand (ENTER TOTAL FROM PAGE 1 SECTION I)

$

(2) Total cash on deposit for Pooling Method (from SECTION II)

$

(3) Total cash on deposit for Dedicated Method (from SECTION III)

$

(4) Total cash (Lines 1, 2 & 3 totaled)

(5) Investments - Pg. 1 (totals Sec tion IV)

(6) Investments - Pg. 2 (totals Sec tion V)

(7) Total cash and investments (total lines 4, 5 & 6 combined)

(8) Less: Unexpended bond and/or note proceeds

(9) Net cash and investments (line 7 minus 8)

VII.

Deposits in Dedicated Method Financial Institutions:

(See Instruction 12)

REQUIRED for banks lis

Name of financial institution (1)

(a) (b) (a)-(b)

Deposit FDIC Insured Uninsured

Amount

Amount Amount

Total Demand deposits: Sec. III. - A …………………………………………..

$

250,000$

$ U.S. Treas. & agencies

Time deposits: regular savings & CD's combined: Sec. III. B …………………………

$

NOW, SUPERNOW, and Money Market

Interest Bearing checking accounts: Sec. III. C ……………………………………

Other

250 000$

Market Value of Total

Totals agree to Supplementary Pages or suppplemental

report provided by Unit

Securities

State of N.C.

/county/municipal

with Third

REPORT OF DEPOSITS AND INVESTMENTS

$

10/27/2016

23

Standard LGC-203

Multiple Page Form to be used by

1. Local Governments who have Investments in items

other than and/or in addition to or the NC Cash

Management Trust

Ø Includes Units with either small or large Investment

Portfolio’s

2. Local Governments who have Depositories that are

not Pooling Banks (Dedicated Banks)

3. Public Housing Authorities – dedicated method of

collateralization required by HUD

4. NC Public Schools – supplemental pages

** Charter Schools not required to complete LGC-203 report

Standard LGC-203 form requirements

Other Investments – 203 report reflects totals

Units are required to send additional documentation

with supporting detail

Excel workbook listing or Statements of the Portfolio details of

“Other Investments” for our detail review

• Specific name of each Investment

• Example: Agency, Security, Commercial Paper

• Purchase date, maturity date

• Purchase Value / Market Value at Report date

• Yield

• Rating at time of purchase (commercial paper)

10/27/2016

24

GovernmentSecurityG.S.159-30(c)(1)-

ObligationsoftheUnitedStatesorobligationsfullyguaranteed

bothastoprincipalandinterestbytheUnitedStates.

**CustodiancanbelistedontheLGC-203reportitself

Descriptionof

Security

Issuer Purchase

amount

Market

Value

Purchase

Date

Maturity

Date

Yield

T-Note1-

10/31/2016

Treasury $15,106 $15,114 11/10/2011 10/31/2016 0.854

T-Note1.5-

1/31/2019

Treasury $19,986 $20,183 2/26/2014 1/31/2019 1.515

Government Agency 159-30 (c)(2)

ObligationsoftheFederalFinancingBank,theFederalFarmCredit

Bank,theBankforCooperatives,theFederalIntermediateCredit

Bank,theFederalLandBanks,theFederalHomeLoanBanks,the

FederalHomeLoanMortgageCorporation,FannieMae,the

GovernmentNationalMortgageAssociation,theFederalHousing

Administration,theFarmersHomeAdministration,theUnited

StatesPostalService.

Custodian Nameof

Specific

Agency

Purchase

amount

Maturity

Value

Purchase

Date

Maturity

Date

Yield

WELLS

FARGO

FEDERAL

FARM

CREDIT

BANK

2,053,357.61 2,175,042.00 01/31/08 12/15/17 4.625%

BANKOF

NEWYORK

FHLMC 1,703,000.00 1,873,657.63 01/30/08 11/17/17 5.125%

10/27/2016

25

Commercial Paper G.S.159 (c)(6)

Primequalitycommercialpaperbearingthehighestratingofat

leastonenationallyrecognizedratingserviceandnotbearinga

ratingbelowthehighestbyanynationallyrecognizedratingservice

whichratestheparticularobligation.

Custodian NameofCP–

CPRatingat

Purchase

Purchase

amount

Maturity

Value

Purchase

Date

Maturity

Date

Yield

WELLS

FARGO

BARCLAYSUS-

A1/F1

2,992,378.33 3,000,000.00 10/17/14 07/13/15 0.310%

WELLS

FARGO

CREDIT

AGRICOLE- A1

/F1

1,996,882.78 2,000,000.00 01/14/15 07/14/15 0.310%

WELLS

FARGO

DCATLLC- A1/

P1

4,996,930.56 5,000,000.00 04/21/15 07/15/15 0.260%

• Email completed form to special address

– lgc0203@nctreasurer.com

• Zero, two, zero, three

• Remember to attach supporting documents

to your emailed document

– e.g. collateral reports, Finistar, CDARS, ICS statements

• All supplemental reports as of report date

Letters and/or emails will be sent by our office -

• When reports are late

• For items that raise questions

• For items that may be compliance violations

LGC 203 Reports

10/27/2016

26

Statutory Violations of NC §159-30

WhatifIhaveaDepositorInvestment

statutoryviolation?

**Confirmedinvestmentviolationsarerequiredto

bereportedtotheUnit’sAuditorandmaybe

disclosedintheunit’sfinancialstatement.

LGC 203 Reports

G.S. § 159-33. Semiannual reports on status of deposits and

investments.

• ……….… If the secretary finds at any time that any funds of

any unit or authority are not properly deposited or secured,

or are invested in securities not eligible for investment, he

shall notify the officer or depository in charge of the

funds of the failure to comply with law or applicable

regulations of the Commission. Upon such notification,

the officer or depository shall comply with the law or

regulations within 30 days, except as to the sale of

securities not eligible for investment which shall be

sold within nine months at a price to be approved by

the secretary. The Commission may extend the time for

sale of ineligible securities, but no one extension may

cover a period of more than one year. (1931, c. 60, s. 33;

1971, c. 780, s. 1; 1979, c. 637, s. 2.)

10/27/2016

27

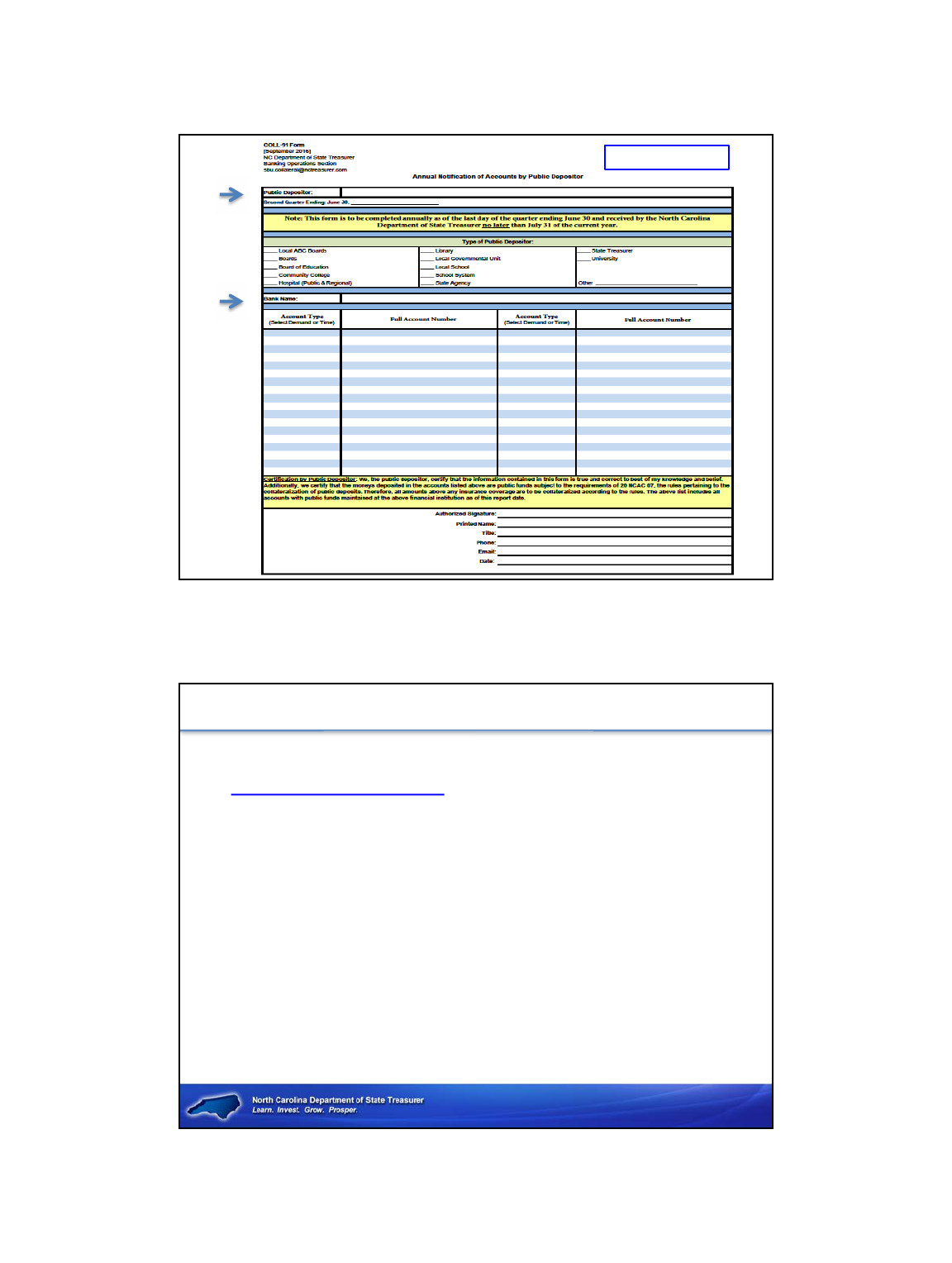

Handout#4

COLL-91– NotificationofPublicDeposit

Why? Required by Administrative Code

20 NCAC 07.0103

20 NCAC 07.0103 Notification By Depositor

(b) As of June 30 of each year, or when requested by

the State Treasurer, the public depositor shall provide

the depository Form INV-91 "Notification of Public

Deposit ", listing the current account names and

numbers of all public deposit accounts, and shall

provide a duplicate copy to the State Treasurer.

Form INV-91 shall be certified by the public

depositor that the statements are correct.

10/27/2016

28

COLL-91 Notification of Public Deposit report form

and Instructions Department of State Treasurer

website . New report form and instructions

beginning with the June 2016 report cycle.

Reports now emailed directly to NCDST Financial

Operations and not to SLGFD.

New Email for COLL-91:

sbu.collateral@nctreasurer.com

COLL-91 Reports

(Notification of Public Deposits)

COLL-91NotificationofPublicDeposit

Notifies depository of collateralization requirement –

• System of checks and balances to ensure the bank and

the Unit agree as to public deposits.

• Alerts the Bank of discrepancies between the Unit’s

account listing and the Bank’s

• Account not coded as public funds will not be covered

by additional collateralization required

COLL-91 forms are reviewed and the accounts matched by the

NC Department of State Treasurer’s Banking Operations

Section to the collateral reports filed by the Depositories

Both the LGC-203 and the COLL 91 reports are required for all

local governments & public authorities, except Charter Schools

10/27/2016

29

COLL-91– NotificationofPublicDeposit

• All public depositors must file the form COLL-91 form

annually, for the quarter ending June 30th

• Due annually: July 25

• Depositories (the banks) providing the Dedicated Method

of collateralization should request the COLL-91 form from

their Public Depositors

• Prepared in triplicate, signed

• original should be mailed to the branch office of the

Depository

• a copy emailed directly to DST financial operations

sbu.collateral@nctreasurer.com - (NEW)

• a copy for your records

Questions or assistance needed?

LGC-203 – DST SLGFD

Becky Dzingeleski 919-814-4287

Becky.Dzingeleski@nctreasurer.com

COLL-91- DST Financial Operations Division

Cherin Bland 919-814-3889

Cherin.Bland@nctreasurer.com

LGC-203 & COLL-91

10/27/2016

30

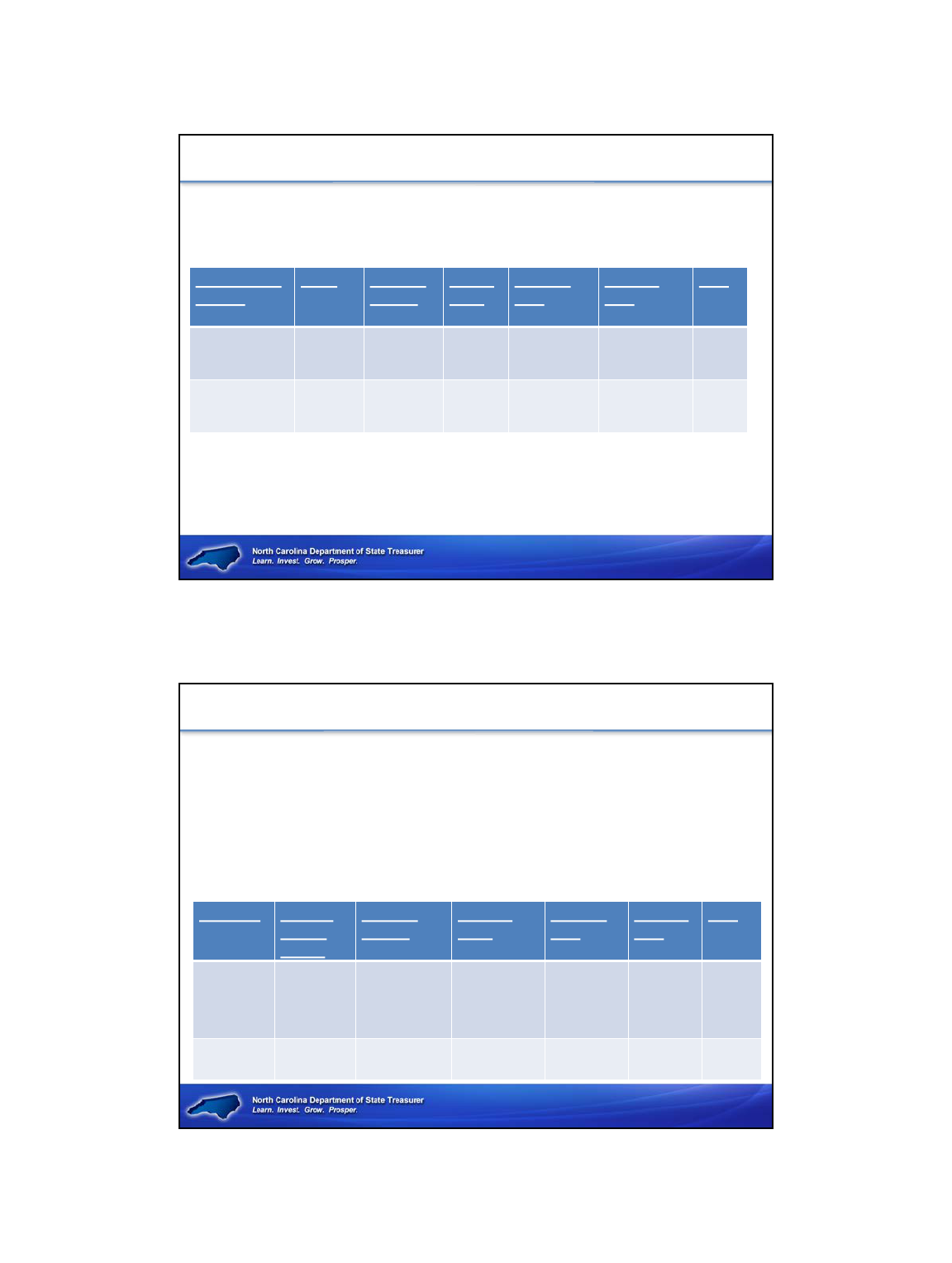

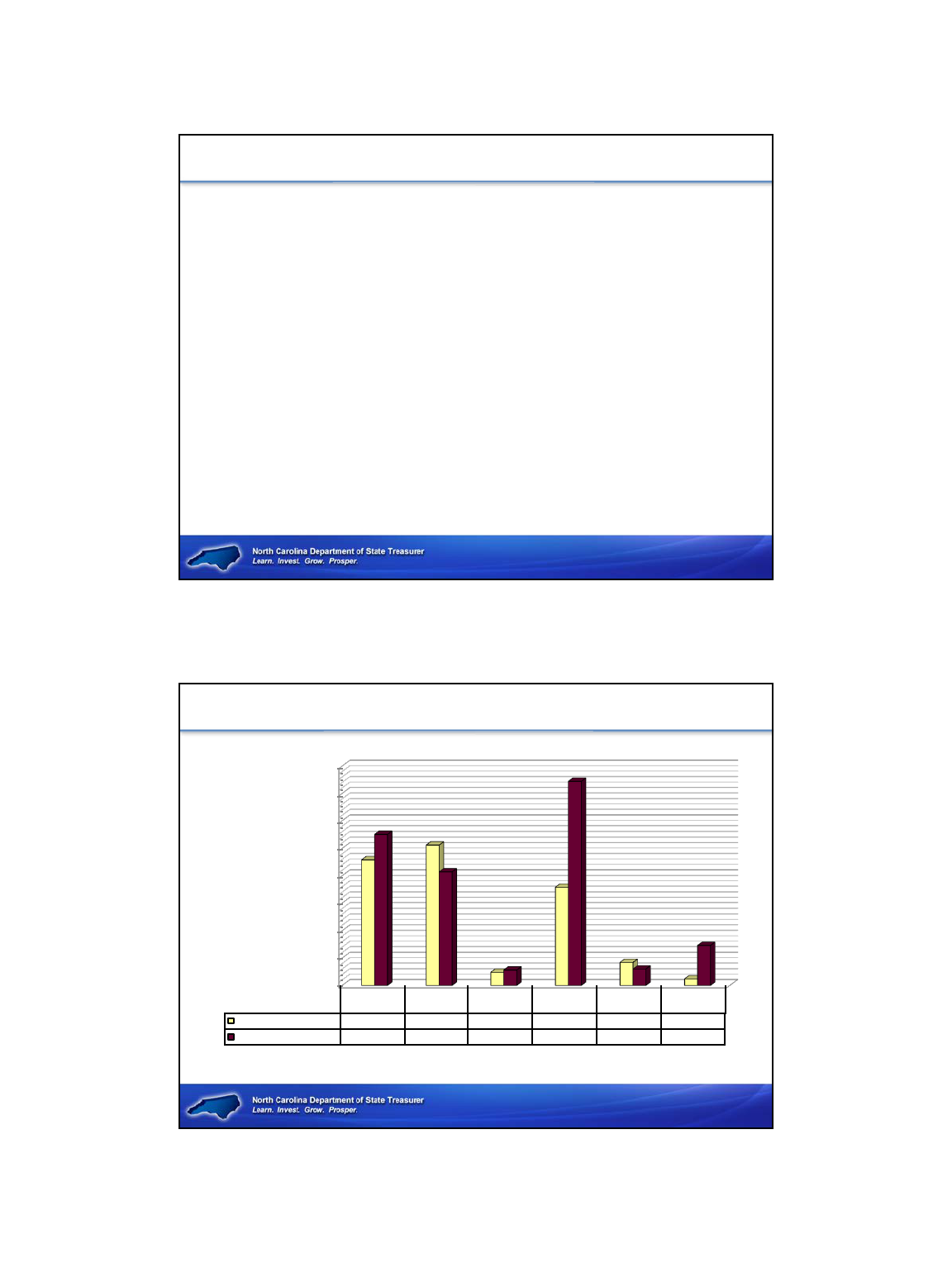

Portfolios

Counties & Municipalities

in North Carolina

Units Investing in the following -

Of553Municipalities

atJune30,2016

Of100Counties

atJune30,2016

GovernmentSecurities 17 GovernmentSecurities 12

GovernmentAgencies 27 GovernmentAgencies 30

CommercialPaper 18 CommercialPaper 29

“Other”: BondProceedsor

expanded Investment

authority

22

“Other”:BondProceedsor

expanded Investment

authority

17

NCCMTCashPortfolio 333 NCCMT CashPortfolio 96

NCCMTTermPortfolio 104 NCCMTTermPortfolio 48

10/27/2016

31

June 2016 County & Muni Statistical Reports

County & Municipal Portfolios Over the last

three years

vWhat they are investing in – combined & separately

vComparisons over time

vDiversity of the portfolio mix

vWhat the June 30, 2016 LGC-203 reports showed for

Counties & Municipalities in North Carolina

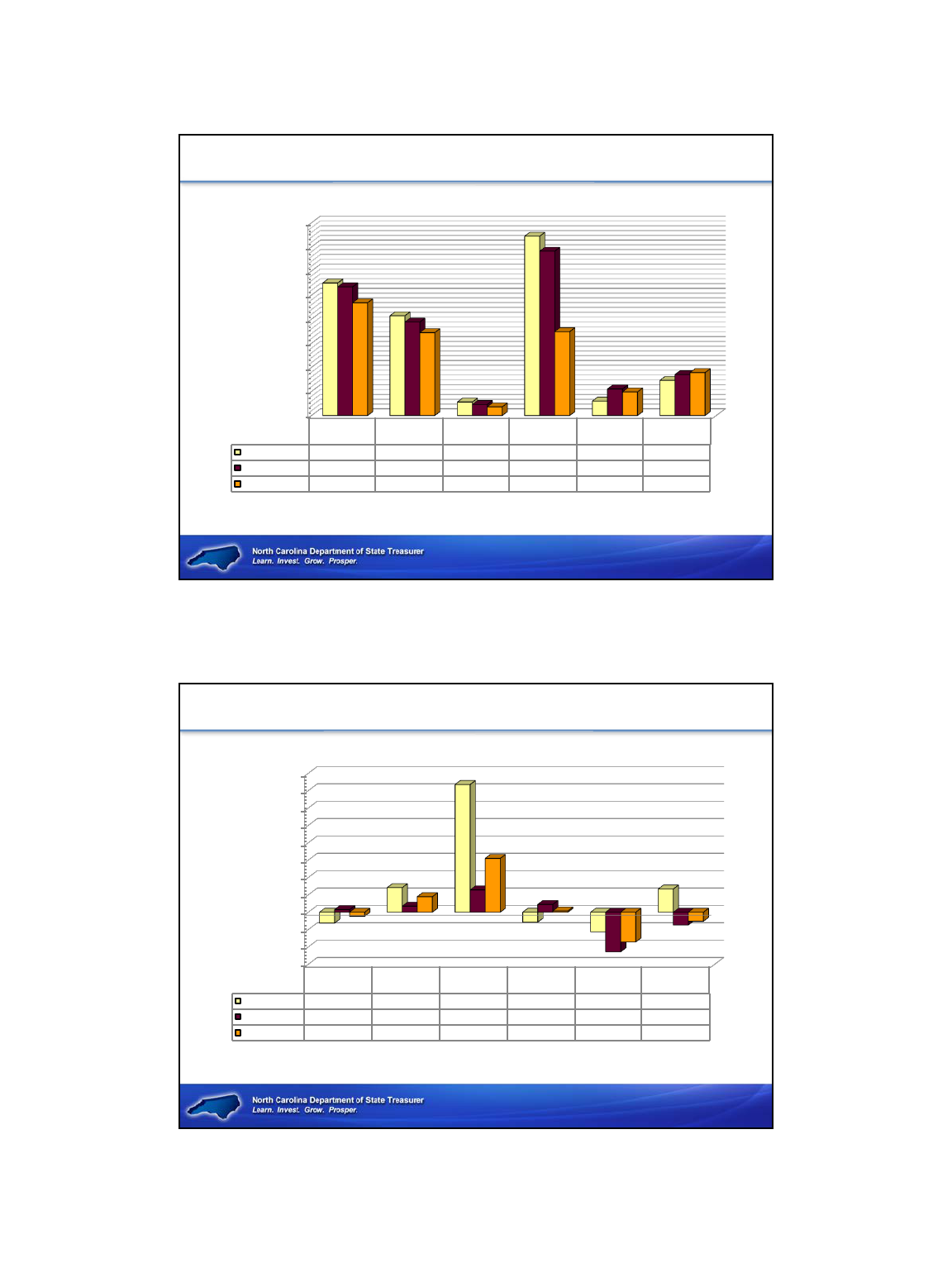

County&Municipal

Combinedportfolio’satJune30,2016

$-

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

$4.0

Deposits NCCMT Government

Securities

Government

Agencies

Commercial

Paper

Other

Counties- $7.42Bil

2.29

2.56

0.24

1.79

0.42

0.12

Municipalities- $9.85Bil

2.75

2.07

0.28

3.72

0.30

0.73

BillionsofDollars

10/27/2016

32

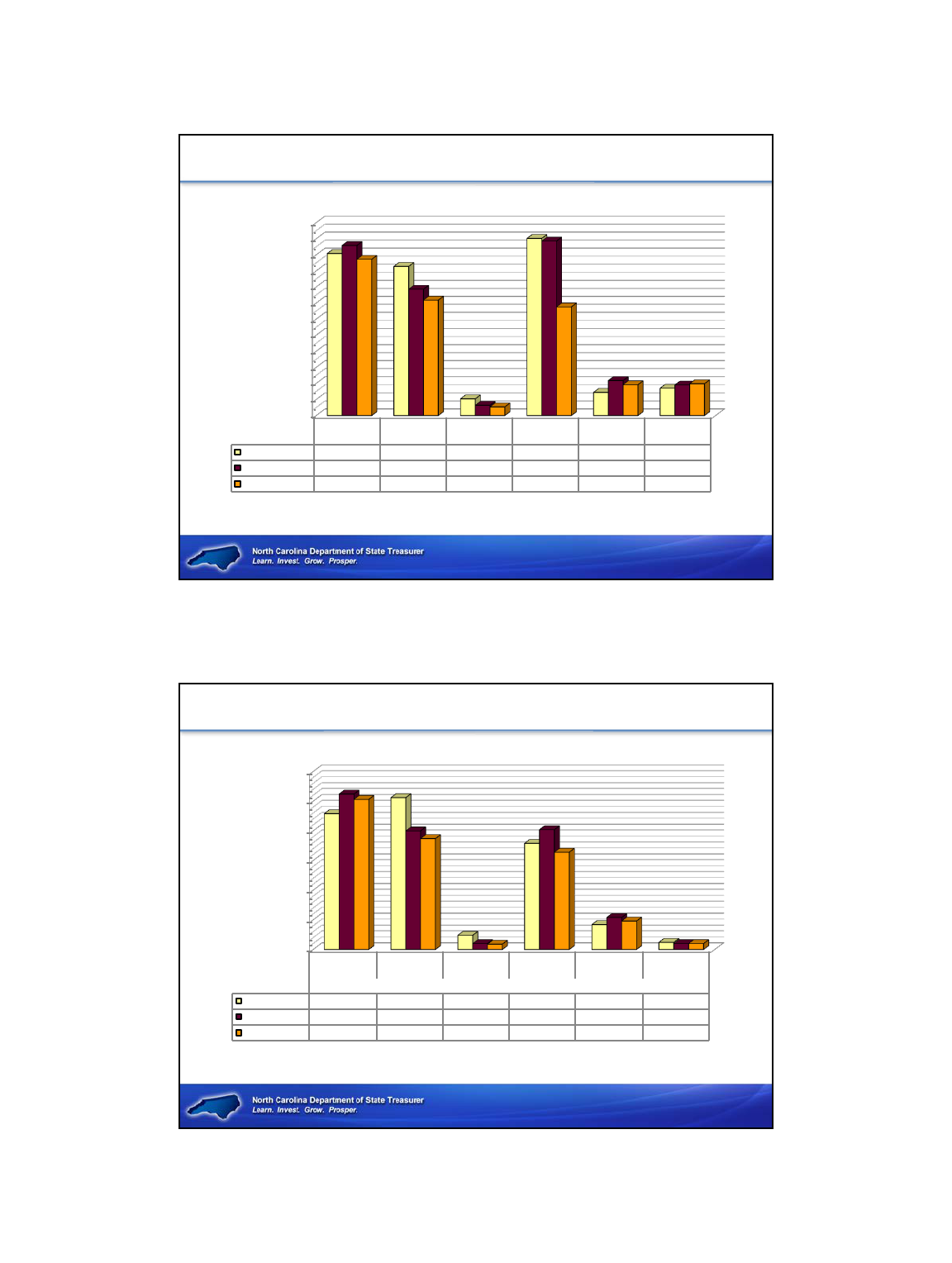

Combined County & Municipal

Deposits & Investments

atJune30,2016- 2015- 2014

$-

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

$4.0

$4.5

$5.0

$5.5

$6.0

Deposits NCCMT Government

Securities

Government

Agencies

Commercial

Paper

Other

2016- $17.28Bil

5.04 4.64 0.52 5.51 0.72 0.85

2015- $17.01Bil

5.29

3.93

0.32

5.43

1.09

0.95

2014- $14.05Bil

4.86

3.59

0.27

3.38

0.96

0.99

BillionsofDollars

County Deposits&Investments

atJune30,2016– 2015- 2014

$-

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

Deposits NCCMT Government

Securities

Government

Agencies

Commercial

Paper

Other

CountyDeposits

2016- $7.42Bil

2.29 2.56 0.24 1.79 0.42 0.12

2015- $7.38Bil

2.62

2.00

0.10

2.02

0.54

0.10

2014- $6.71Bil

2.53

1.87

0.09

1.64

0.48

0.10

BillionsofDollars

10/27/2016

33

MunicipalDeposits&Investments

atJune30,2016- 2015- 2014

$-

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

$4.0

Deposits NCCMT Government

Securities

Government

Agencies

Commercial

Paper

Other

2016- $9.85Bil

2.75 2.07 0.28 3.72 0.30 0.73

2015- $9.65Bil

2.67

1.94

0.23

3.41

0.55

0.85

2014- $7.36Bil

2.34

1.72

0.18

1.74

0.49

0.89

BillionsofDollars

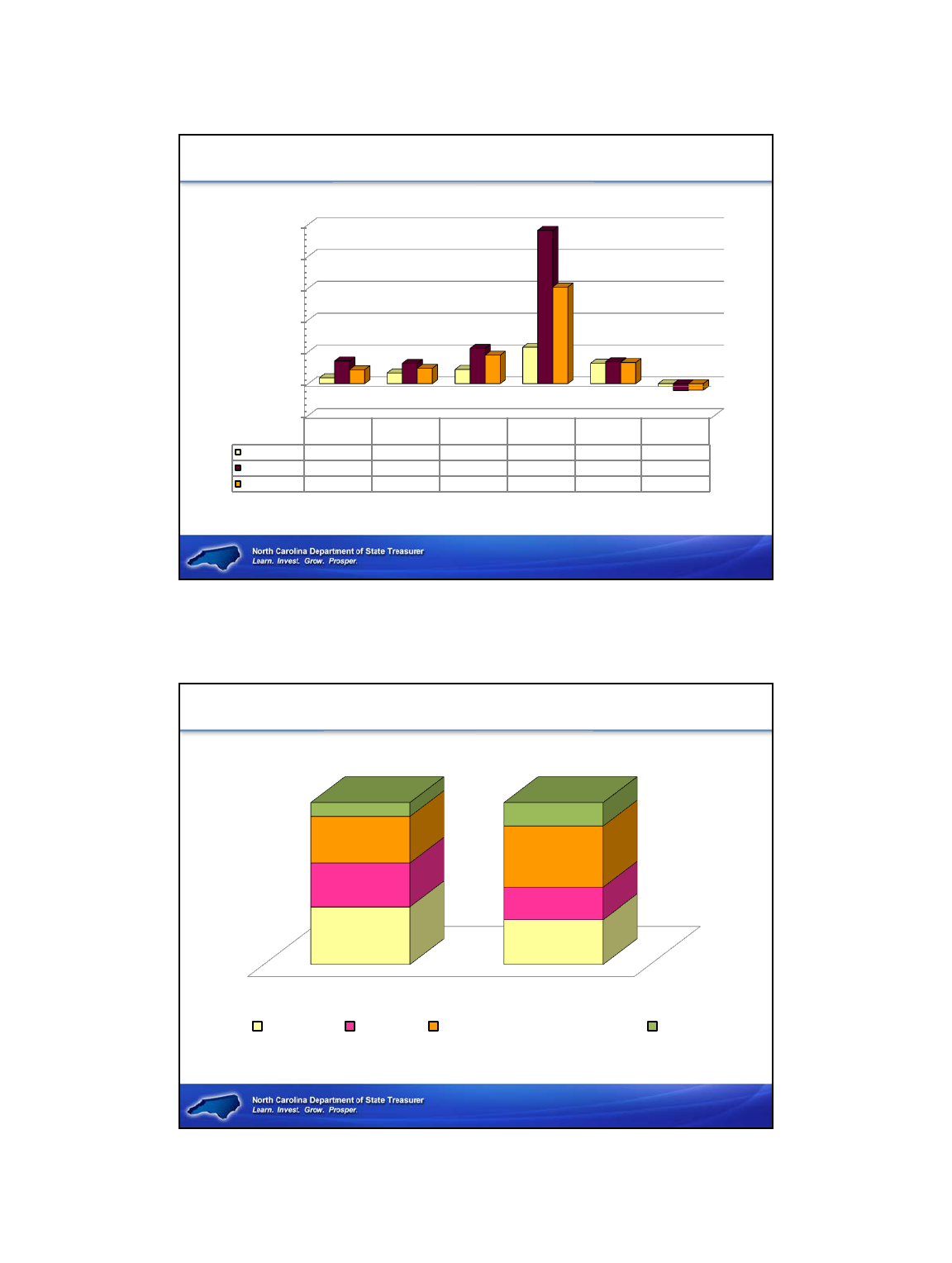

PercentChangefrom2015to2016

-60.0%

-40.0%

-20.0%

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

120.0%

140.0%

160.0%

Deposits NCCMT Government

Securities

Government

Agencies

Commercial

Paper

Other

Counties

-12.45%

28.34%

147.08%

-11.39%

-22.53%

26.73%

Municipalities

3.00%

7.02%

25.71%

9.00%

-45.55%

-14.65%

Total

-4.65%

17.84%

61.99%

1.43%

-34.22%

-10.42%

%Change

10/27/2016

34

PercentChangefrom2014to2015

-20.0%

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

Deposits NCCMT Government

Securities

Government

Agencies

Commercial

Paper

Other

Counties

3.69%

6.74%

8.92%

22.89%

12.82%

-1.79%

Municipalities

14.26%

12.75%

22.19%

96.32%

13.79%

-4.31%

Total

8.77%

9.62%

17.89%

60.67%

13.31%

-4.06%

%Change

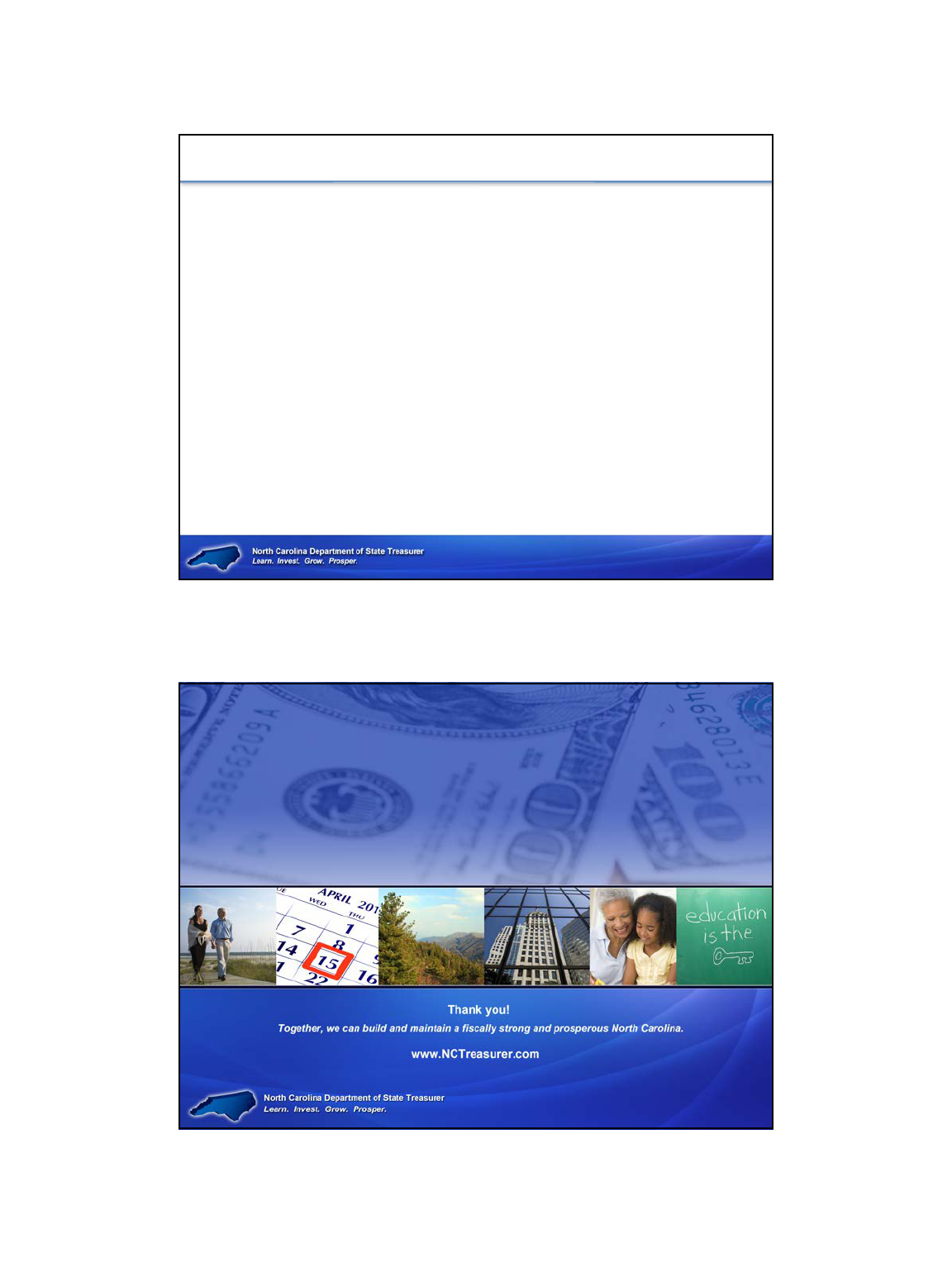

County & Municipal

PortfolioMix- June30,2015

Counties Municipalities

35.6%

27.7%

27.1%

20.1%

28.7%

37.7%

8.6%

14.6%

Deposits NCCMT Gov'tSecurities&Agencies Other

10/27/2016

35

ALL NCLocalGovernment&Public

AuthoritiesInvestments

• NCCapitalManagementTrustCASHPortfolio

583of1153– 51%

• NCCapitalManagementTrustTERMPortfolio

178of1153– 15%

• GovernmentSecurities– 42of1153– 3.6%

• GovernmentAgencies- 74of1153– 6.4%

• CommercialPaper- 50of1153– 4.3%

• Other– 57of1153- 5%